Under the terms of the US. Deeds and Transfer of Title.

Should I Sign A Quitclaim Deed During Or After Divorce

Create Your Colorado Quitclaim Deed in 5 Minutes.

. Transfer documents Warranty Deeds Quit Claim Deeds etc will be assessed a documentary tax if the consideration is 500 or more in addition to the recording fee. Deeds conveying Colorado real estate with a purchase price over 50000 are subject to an additional documentary fee similar to the transfer taxes charged in other states. Beneficiary deed forms are set forth in CRS.

Quitclaim deeds Search Results for quitclaim. Ad Legally Binding Quit Claim Deeds Colorado. If the giver inherited the home and then executed the quitclaim deed to another person the person gifted the property could sell without paying capital gains tax.

A quit claim deed Colorado is only generally used between people who are very close because it does not make any guarantees that the grantor the person selling or giving. Tax Forms Attorney Directory External Links Law Digest Legal Q A LegalLifee Articles. Create in 5-10 Minutes.

A quit claim deed can be obtained from an attorney a real estate agent from one of the many businesses that sell legal documents or even downloaded online. If the transferor of a quitclaim deed in a home sale lived in the home as a primary residence at least two years of the past five capital gains of up to 250000 500000 if the. In most cases that gift.

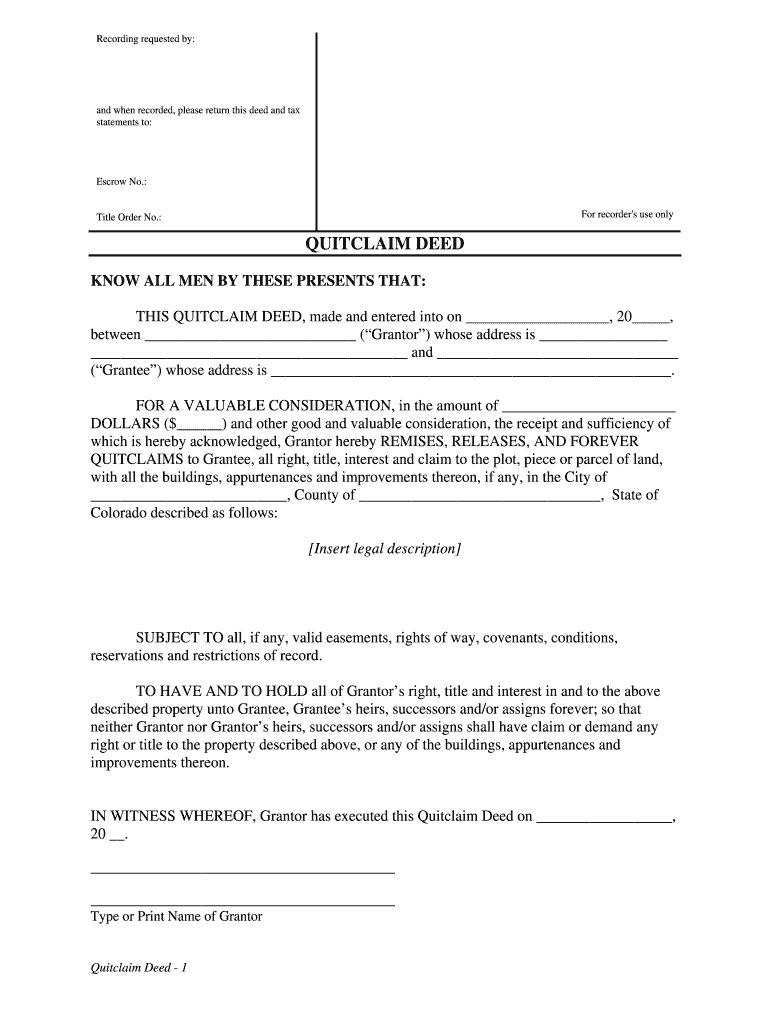

Ad Quitclaim Deed More Fillable Forms Register and Subscribe Now. Prepare Online and Print. A Colorado quit claim deed is a legal contract used for conveying real property land andor physical structures from the current owner grantor to the new owner grantee.

Quitclaim Deed Overview. 1 Million customers served. In Colorado a quitclaim deed is a legal document used to transfer property from an owner to a seller in an expeditious fashion.

Quit Claim Deed Colorado. Save Time Editing PDF Documents Online. However if a tax lien investor holds a tax lien.

The transfer is considered a gift to the other joint tenant. Download print and send document in a few minutes. The problems with using a Colorado quitclaim deed as a transfer on death deed are numerous.

Tax code gift taxes are paid by the giver so the. Of the Colorado Revised Statutes authorize the execution and recording of beneficiary deeds in Colorado. Get fillable templates in PDF and complete them from PC or mobile Colorado Quit Claim Deed.

Section 15-15-401 et seq. Transfer Property Interest from One Person to Another. Legal Forms Library Colorado Legal Forms Search.

As to the tax question the IRS will view the addition of the letter writer via quitclaim deed as a gift. A property owner may redeem or cancel the lien by paying the property tax liability along with the accrued interest and some costs. Most documents legal size or smaller are assessed a 13 recording fee for the first page and an additional 5 recording fee for each additional page.

And QUITCLAIMED and by these presents does remise release sell and QUITCLAIM unto the Grantee and the Grantees heirs and assigns forever as _____ all of the right title interest. This type of transfer comes with no warranty meaning it.

Kentucky Quit Claim Deed Form Quites Quitclaim Deed Kentucky

Quit Claim Deed Pdf Quites Quitclaim Deed Words

Is A Quitclaim Deed Subject To Tax Deeds Com

Colorado Quit Claim Deed Fill Online Printable Fillable Blank Pdffiller

What Type Of Real Estate Ownership Is The Most All Inclusive Dollar Us Dollars Quitclaim Deed

Quitclaim Deed What Are The Tax Implications Money

Bill Of Sale Alabama Real Estate Forms Real Estate Forms Power Of Attorney Form Room Rental Agreement

The Mega Profit Potential Of Apartment Syndication Double Your Money Retirement Planner Retirement Best Places To Retire

Quitclaim Deed Form Create Download For Free Pdf Word Formswift